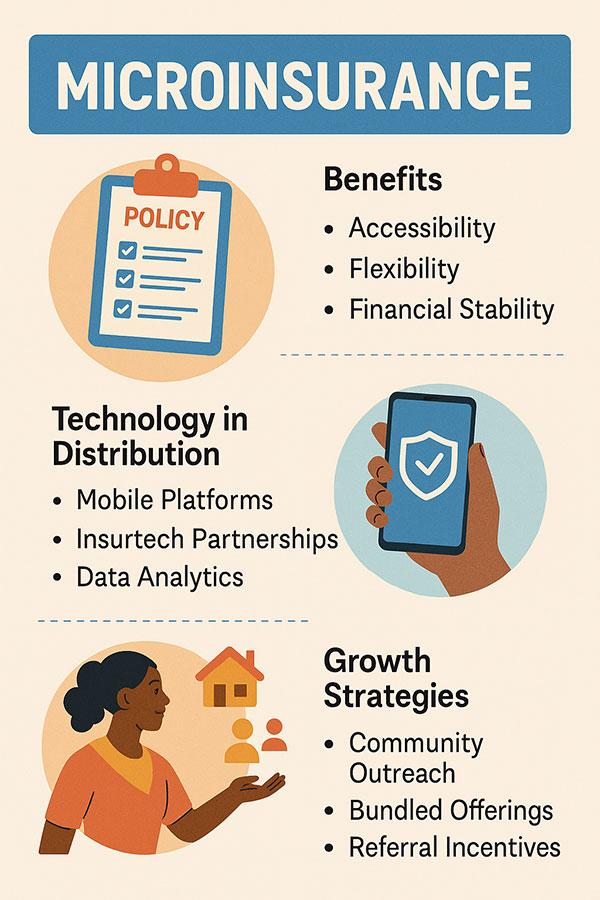

Microinsurance

Designed to serve low-income individuals and underserved communities by offering affordable, tailored coverage for everyday risks. As traditional insurance products often carry prohibitive premiums and complex requirements, microinsurance empowers agents to diversify their portfolios and extend protection to new client segments.

1. The Benefits of Microinsurance for Low-Income Clients

- Accessibility: Simplified underwriting and low premiums make coverage feasible for clients with limited budgets.

- Flexibility: Policies often cover specific, targeted risks (e.g., mobile device damage, small-scale agriculture), matching clients’ unique needs.

- Financial Stability: Even small payouts can prevent setbacks after unexpected events, fostering trust and long-term loyalty.

2. The Role of Technology in Distribution

- Mobile Platforms: Mobile wallets and SMS-based enrollment vastly reduce paperwork and speed up onboarding.

- Insurtech Partnerships: Collaborations with fintech startups can streamline claim processing and policy management.

- Data Analytics: Agents can leverage client data to design tiered products, optimize pricing, and minimize fraud.

3. Growth Strategies for Agents

- Community Outreach: Partner with local NGOs and cooperatives to educate potential clients and build credibility.

- Bundled Offerings: Combine microinsurance with financial literacy workshops or savings programs.

- Referral Incentives: Implement small rewards for existing clients who refer friends or family, fueling organic growth.

Microinsurance represents a win-win: agents tap into a vast, underserved market while communities gain vital financial protection. By embracing technology and community partnerships, independent agents can position themselves as inclusive, innovative leaders.